UPDATE! The Job Blog now has a W-4 form automated software tool to help you complete your W-4 form in the easiest way possible. Continue reading if you still want the manual version. Otherwise, try out the tool and complete your form in minutes—or even seconds!

Completing a W-4 form, officially called the “Employee’s Withholding Certificate,” is one of the forms you’re required to complete before your new employer can deduct taxes from your check when they pay you. What you put on the form tells your employer how much money to deduct from your paycheck for federal, state, and local taxes in the U.S. Only one form is needed for all three government sectors.

Changes to the W-4 form

In 2020, there were significant changes in the W-4 form. These are the result of the 2017 Tax Cuts and Jobs Act that no longer allows personal exemptions. The new form uses two ways to determine how much tax to withhold from your pay and avoid having to owe money come tax time:

- How many dependents you claim. The earlier W-4 form used exemptions to determine withholding amounts.

- Use of a deductions worksheet. Among other things, the worksheet helps to account for the taxes you and/or your spouse are having withheld. The correct deductions can be computed as joint income rather than separate, which makes a difference in paying the right tax amount.

The new W-4 form was designed to make it easier to complete, especially in more complicated situations. In some cases, it can be a piece of cake. In others, not so much. Either way, don’t sweat about it too much. If it’s wrong, it can be easily changed!

List of What You Need to Complete the W-4

To make completing the form easy, gather up the information you’ll need when you go into work your first day. This is when the HR department will ask you to complete all the paperwork to begin your new job. Here is the list of items you’ll need to complete the W-4:

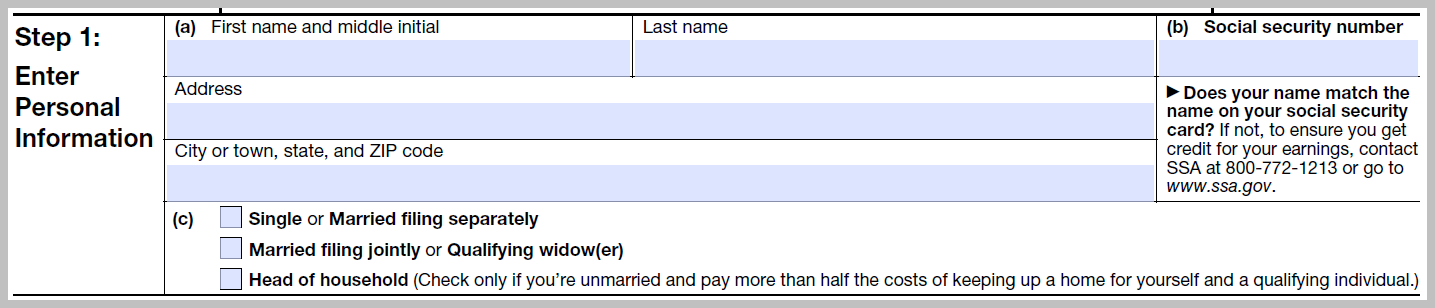

- Basic Information. This includes name and address.

- Social security number. Make sure you have it with you!

- Tax filing status. Will you file as

- Single or Married filing separately,

- Married filing jointly or Qualifying widow(er), or

- Head of household?

- Latest paycheck stub(s) from:

- Any other jobs you’ve held in the current calendar year

- Any jobs your spouse has held in the current calendar year

- Dependent info. Make sure you know how many dependents you can claim. If you have children, you’ll need to determine which parent will include them as dependents on their W-4 form. There will be taxes owed if you both include them. See the “How To” section below about claiming dependents for more detailed information.

- Your latest completed tax return. This is only necessary in certain situations: (1) If you use the tax estimator and if you wish to be as close to the withholding the right amount as possible, or (2) if you want more or less tax withheld due to income you’ll receive that isn’t taxed or very large deductions you will take at tax time.

- A calculator. You’ll only need one if you have to complete the worksheet. There are special W-4 calculators online, but any calculator on your cell phone or otherwise will work.

The 5 Steps to Completing a W-4 Form

STEP 1: ENTER PERSONAL INFORMATION (NO SWEAT)

Here you simply complete the boxes with your name, address, social security number, and tax filing status. If you gathered this above, it is one of the easiest sections to complete.

Believe it or not, you might be able to jump to Step 5 at this point, sign and date the form, and be done with it! You only need to complete steps 2 through 4 if they apply to you. If you are single with no dependents, or married filing separately with no dependents, you don’t need to complete steps 2 through 4 as you’ll be taxed accordingly. It might be worth skimming them anyway to make sure nothing applies to you.

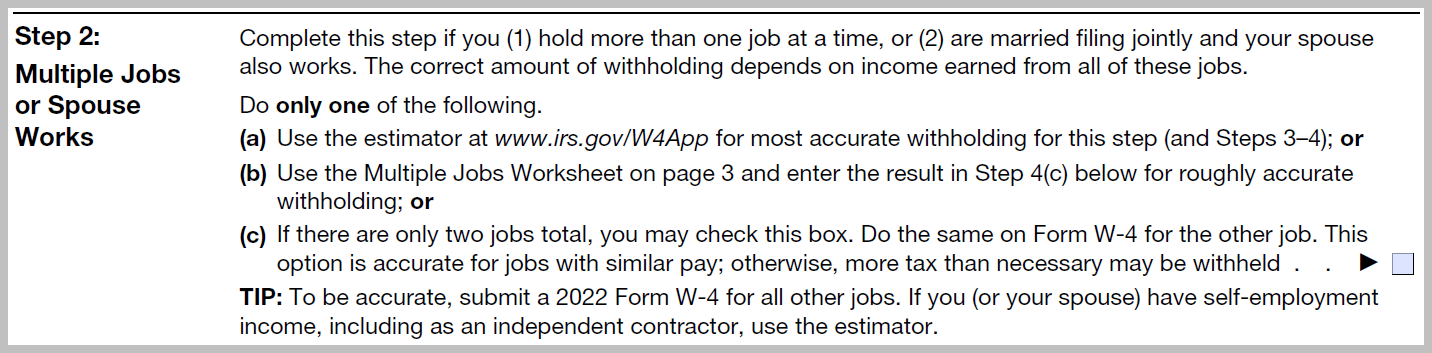

STEP 2: MULTIPLE JOBS OR SPOUSE WORKS

This section could get more complex, depending on your situation. You’ll need to pay attention to section 2 if:

- You are working at more than one job at the same time, or

- You are married filing jointly and your spouse also works.

If none of the above apply to you, skip to section 3. Unfortunately, you will still need to refer to section 2 since it contains instructions you’ll need for section 3.

What you calculate in section 2 is actually not entered in section 2. It is entered in section 3 or 4. There’s only one box you can check in section 2, which is on line c. If you are working 2 jobs between you and your spouse (and no more), then check this box. Whether you check this box or not, you still need to complete section 3.

The main purpose of Step 2 is to come up with a base tax amount that, combined with your dependent choice and other deductions, is used to deduct the right amount of taxes from your paycheck. Step 2 uses wages from previous jobs you held that same year, dual jobs, and your spouse’s job(s) if you are married and filing jointly. You’ll use one of two methods to find this base tax amount: either the online tax withholding estimator or the worksheet and tax table.

Method 1: The W-4 Calculator

The Job Blog’s W-4 Calculator can help determine your withholding information. Answer the on-screen questions about filing status, salary, and dependents to calculate what to claim on your W-4 form.

Method 2: The Worksheet and Tax Table

Page 3 of the W-4 form contains a worksheet for use in determining the base amount to use for withholding. The tax tables are on page 4. Note that if the lowest-paying job has annual wages of $120,000 or more (yeah right?), you’ll either need to use the estimator OR use tax tables that go higher than the ones provided with the W-4. Those higher tax tables are in Pub 505.

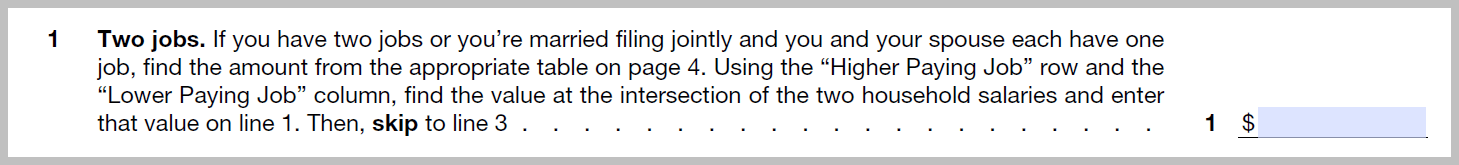

Complete lines 1 or 2 on the worksheet, but not both

Complete line 1 if there are only 2 jobs between you and your spouse that need to be calculated. This can happen if you are single and working 2 jobs at the same time, or if you only have one job but you are married filing jointly and your spouse also has a job. The main thing is, that income from only 2 jobs should be computed here. If there are more than that in your mix, then ignore line 1 and go to line 2 instead.

To find what amount to put in line 1, compute either:

- As a single filer with 2 jobs – the annual amount that you will make this year at each of your jobs, or

- Joint filing, you and your spouse each have 1 job – the annual amount you will make from your job, and the annual amount your spouse will make from their job.

Here is where your paycheck stub(s) for any existing jobs will come in handy. Take the gross amount paid from the last paycheck (assuming it is from a normal paycheck) and multiply it by the number of paychecks you’ll receive in a year. This would be 52 if you receive checks weekly, 26 if you get paid every other week, and so on.

If you started your job and only know your hourly wage, then multiply it by the number of hours you will work each week and then by the number of pay periods in the year. For example:

$16.25 (per hour) x 40 (hours per week) x 52 (weeks per year) = $33,800

Regardless of when you started your job (either January or December), you’ll use the $33,800 number for your calculation. Now find the other job wage (either for your spouse or for your other job) and proceed to the tax table.

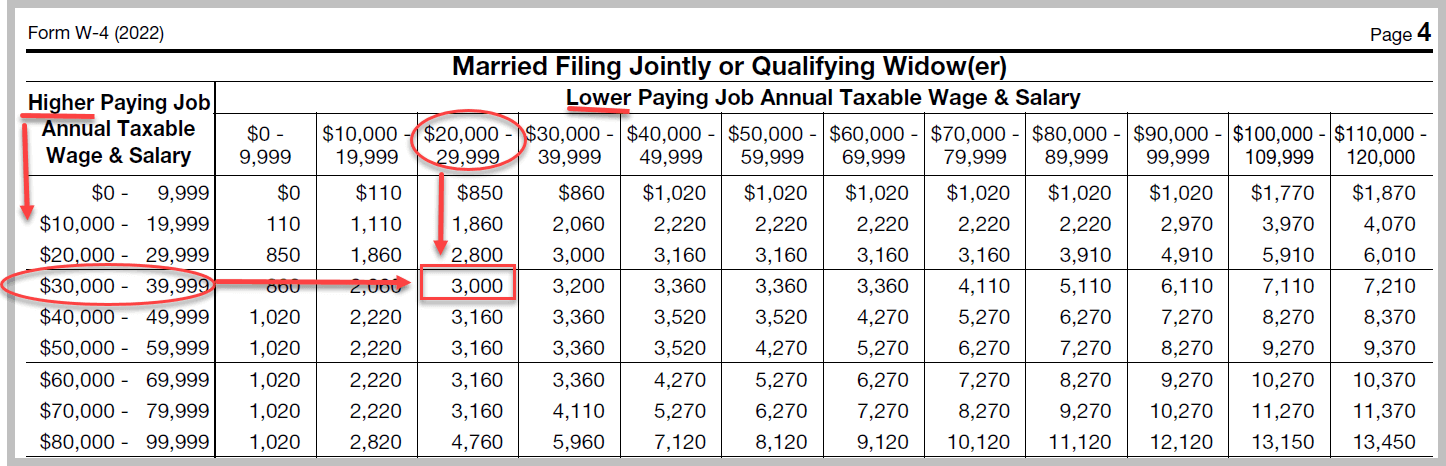

Using the tax table

When you finish gathering the annual wage for both jobs, you’ll have two numbers, one from each job. Now go to the tax tables on page 4 and find the correct section for your tax filing status. Using your higher wage number, find the range where the wage fits using the left-hand column. Circle it if you like.

Using the lower-paying job, find the range where it fits using the row of wage ranges along the top of the table. Circle that too if you like.

Now find where these two amounts intersect on the table as shown in the red square below. In this case, the number is 3,000.

Once finished, skip line 2 and move to line 3 on the worksheet.

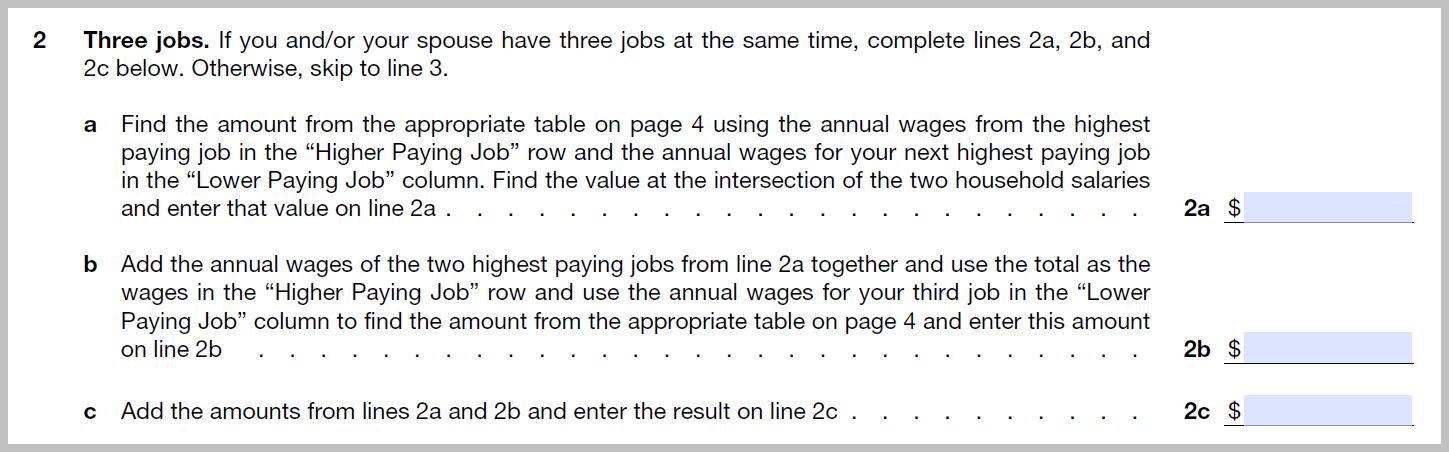

Complete line 2 if there are 3 jobs to consider between you and your spouse. This would mean one of you is working 2 jobs at the same time.

To complete line 2, gather the annual wage amounts from all three jobs using the method noted above in line 1. Instead of 2 wages, you will now have 3.

Box 2a: Use the highest and the second highest wage numbers you have, go to the tax table, and use the method as outlined in step 1 above to find the amount that intersects on the table. Put that number in box 2a.

Box 2b: Go back to your three wage numbers and add the two highest ones together. Now go back to the tax table. Using the number you just received by adding two jobs together, find the range using the Higher Paying Job column on the left. Now take your lowest paying job number and find the range along the top row of job ranges. Find where those two intersect and put that number in box 2b.

Box 2c: Add the numbers in boxes 2a and 2b together. Put the result in row 2c. Now move to line 3 on the worksheet.

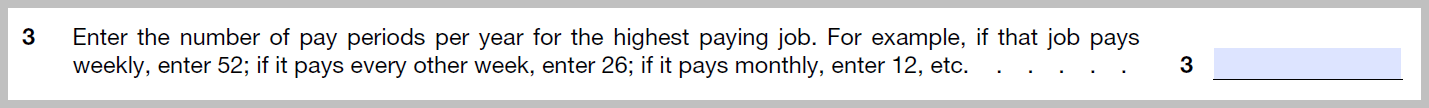

Line 3 asks for the number of pay periods per year of the highest-paying job in your mix. If the highest paying employer pays weekly, put in 52. If every other week, put in 26. And so on.

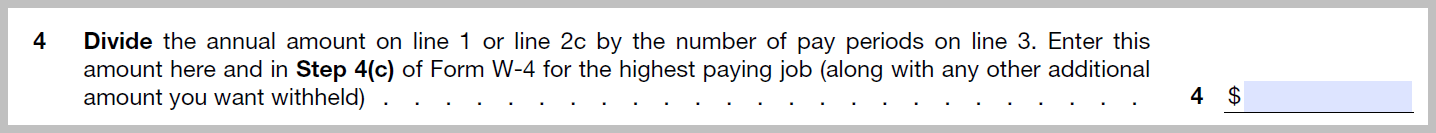

Line 4 asks that you do a little division. Pull out your calculator. You’ll either have a number in line 1 or in line 2c above. Take that number and divide it by the number you put in line 3. Put that number in line 4 of the worksheet, and also in Step 4c on your W-4 form.

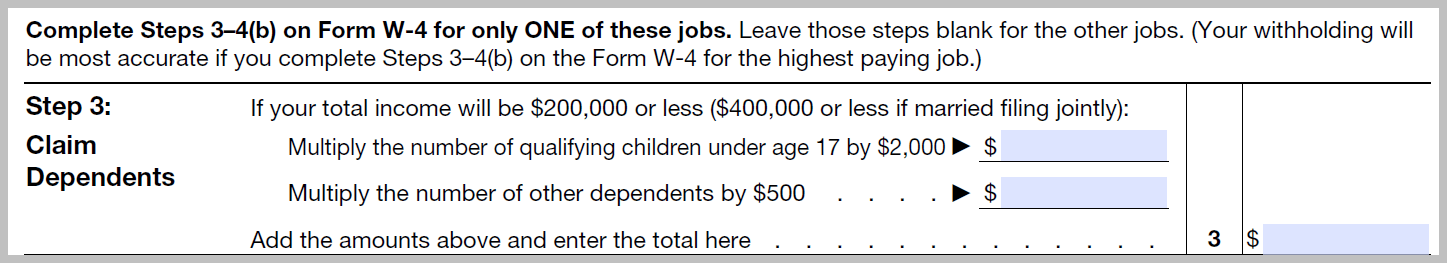

STEP 3: CLAIM DEPENDENTS

Claiming dependents on your W-4 is pretty easy, assuming you know the number of dependents you should claim:

- If you have children under the age of 17 that you can claim as dependents, multiply the number of children by $2,000. Put that amount in the first box.

- If you have other dependents (not including yourself), multiply the number of other dependents by $500 and put that amount in the second box.

Now add any amounts in the two boxes together and put the total in box 3.

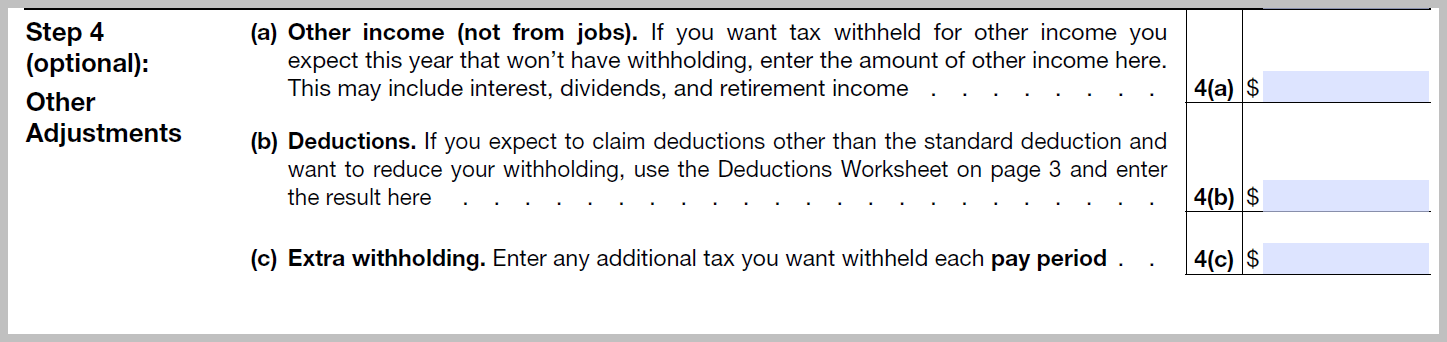

STEP 4 (OPTIONAL): OTHER ADJUSTMENTS

Completing this step is optional and can be done with the aid of the W-4 worksheet and your last income tax return. You may want to complete this section if you:

- Have income that is otherwise not taxable such as Dividends, earned interest, or retirement income.

- Expect to claim deductions other than the standard deduction.

- Would like to withhold extra tax each pay period for some reason.

Detailed directions on completing this step are outside the scope of this article but feel free to review the worksheet and other IRS publications for assistance.

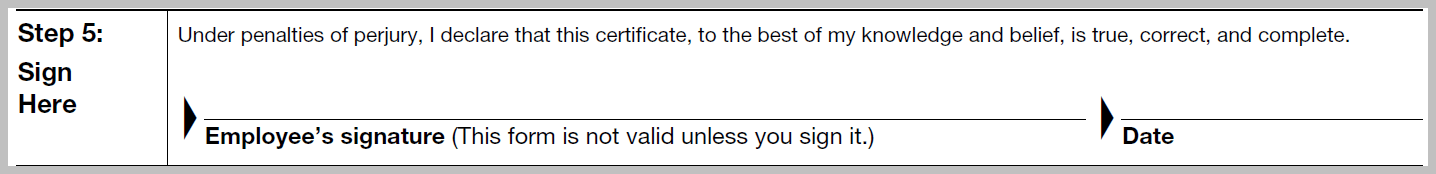

STEP 5: SIGN AND DATE

You’re almost done. Finish the form by signing and dating it. It’s time to get on with your new job!

Bottom Line and Some Tips

When it comes to the W-4, your calculations do not have to be perfect. If you don’t have actual numbers, use estimates. You have enough going on with your new job without worrying about the W-4.

- Even if you make a mistake and owe money come tax time, you won’t have a penalty unless you owe over $1,000.

- If you end up owing money at tax time, consider filling out another W-4 to have more taxes taken out of your paycheck a little at a time rather than risk owing a large amount next year at tax time.

- If you will make less than $10,000 in the tax year, you won’t owe any taxes. You are then exempt. There are other exempt situations also. To claim exemption status, you still need to fill out a W-4 and follow the exemption instructions on page 2. To keep your exempt status, you will need to fill out another W-4 every year by February 15, else you will start being taxed again.

Finally, try to remember to complete a new W-4 when you experience a major life change. A new child, a significant increase or decrease in income from you or your spouse, or a divorce are all examples of major life changes that might be flagged to complete a new W-4.

While completing the W-4 might seem complex, especially with a post this long, when all is said and done it isn’t that complicated. Anything new can be hard at first. But when it comes to the W-4, you can do this!