Are you expecting an income tax refund this year? If so, you are probably looking forward to the day you get that check or see the deposit in your bank account. You may have given a lot of thought as to how you’ll spend your money, or you might just “do what you always do,” and spend it on whatever.

With all that money in hand, some of us make fast decisions without thinking. It’s pretty easy to do. Yet thinking about how you’ll spend it before you have it can help you use it for smart purposes that will make you much happier in the long run. Here are some smart ways to spend your income tax refund this year.

Save It

Saving your income tax refund might seem like the last thing you want to do with your money, but when you think about what you are going to save it for, it can improve your outlook on life now. It can also make you very glad that you saved it for when it is actually used. Here are some possibilities where saving it will make you happier long-term.

An Emergency Fund – If you don’t have an emergency fund at all or if it is very low on funds, it’s a good time to start or replenish it. Even if you only put a certain amount in there, or a little at a time, you’ll be glad you did when your car breaks down, you have an accident, or experience anything unexpected that requires extra money right away.

A Vacation – When was the last time you took a really good vacation? Many fun vacations can happen without a lot of money. But having extra cash can mean a lot for you and your family, especially if most vacations in the past have been very low budget. You’ll have fun and experience something new. Plus the memories that a special vacation creates will last forever–for both you and your friends or family members.

Down Payment on a House – If you’ve been dreaming of homeownership and have always felt it would never happen for you, know that it never will unless you begin saving up a down payment. Owning can be less expensive than renting, and you’ll have so much more control over your environment as a homeowner. But that down payment can be hefty to keep your monthly mortgage payments to a do-able level. Adding some of your tax refund to the house down payment fund can bring you that much closer to owning a home.

Increase its value

If someone asked you to give them your tax refund now and promised they would double it in a year and give it back to you, would you do it? Depending on your situation, you could make that happen yourself. Here are a few ways to increase the value of your refund.

Pay Down Debt: Credit Cards, Car Loan, or Mortgage

Take a little time and write down information about what you currently owe:

- Who you owe

- How much you owe today (or on your last statement)

- The interest rate you’re paying

- How much you’re paying per month

Then use a handy calculator and figure out how long it will take you to pay it off – and how much you’ll have paid after it is paid off – assuming you don’t add anything to the loan.

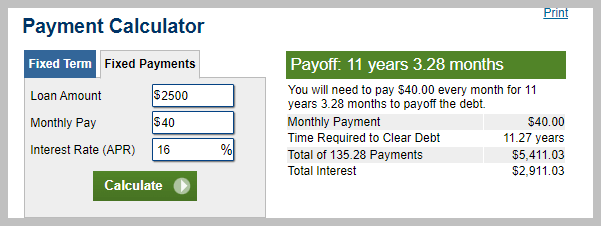

Here’s an example: You owe $2,500 now on a credit card, are paying 16% interest, and your payments are $40 a month. Now click on the link for the handy calculator above and add these numbers to the Fixed Payment tab. It will take 11 years and 3.28 months to pay off your loan, and you’ll have paid $2,911 in interest alone – more than the amount you owe now!

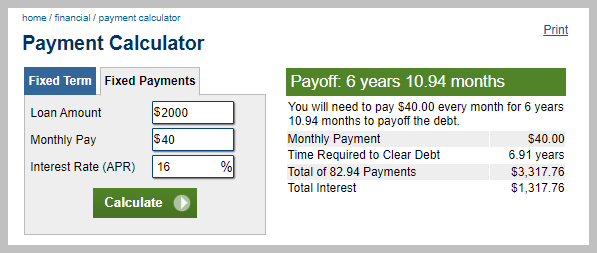

If you put $500 of your income tax refund on this loan, you’ll now owe $2,000. Run the numbers again and there is a huge difference.

Paying $500 on the $2,500 loan while maintaining the $40 per month payments brings your total interest down to $1,317.76 – a savings of $1,593.87! Your payoff is now 6 years, 10 months instead of 11. How smart you are for more than tripling your refund. You paid $500 and saved $1,594. You actually earned $1,093.27 off your original $500! How much better to have this in your pocket than in the banks who lent you the money.

Programmable Thermostat

If your refund isn’t that much, or if you can put some of it towards a programmable thermostat for your home, here’s a pretty simple way to increase the value of your tax refund. According to ENERGY STAR, programmable thermostats save the average household $180 per year.

Programmable thermostats can be purchased at $129 and up, so you could save $50 your first year, and $180+ per year each year after that. It will actually be more savings each year that energy costs rise and thus more savings too. Be sure the thermostat is compatible with your furnace, and check your utility company for possible discounts.

Insulation or weatherproofing – If you’re fortunate enough to own your own home, adding insulation might be a great way to reduce your energy costs and get your tax refund to pay you back. Even if you’re just renting, it might pay to add low-cost weather stripping around doors and removable window film over windows. It’s also worth asking your landlord if you can be reimbursed for the products if you do it yourself.

Enroll in a Dave Ramsey or similar course – Dave Ramsey is a popular radio personality who shares “practical answers for life’s tough money questions.” While much of his advice is free, he also offers books, videos, and courses for those truly interested in getting out of debt. If you have a lot of debt, this is one way that your tax refund will pay you back many, many times – assuming you follow his advice.

There are many other advisors and he is not the only good one. Be careful of debt consolidators though. They charge a hefty fee and it can make it easier for you to rack up more debt once you’ve consolidated. If you can work on getting debt-free yourself along with some guidance, you’ll pay a lot less to get there and develop the right habits to stay out of debt going forward.

Spend it

Spending your refund can still make you happy, as long as you’ve thought it through and feel it’s the best use of your funds. Keep in mind that in many instances, the joy of spending it on one-time things usually doesn’t last long and in most cases will not pay you back. But it can also be worthwhile. Here are some ideas:

Small luxury for yourself – If you received a bigger refund and decided to use it for one or more of the smart uses above, spending some of it on a small luxury for yourself can make you feel a lot better. You’ve been smart and now you’re rewarding yourself.

Donate, pay it forward, or do a random act of kindness – Again, this should be done in conjunction with another use of your funds. But donating some of your refund, paying it forward as a surprise to someone, or purchasing something as a random act of kindness for someone you don’t know can brighten your day and also benefit the recipient of your generosity. Regardless of where we are in life, there are always people who are worse off.

Something special for a family member – Sometimes family members run into bad times. Or children wish, hope, and pray for something special that they never think their parents could afford. Sometimes it isn’t even that big of a thing but there is never any extra money. Using part of your refund for a surprise gift or to help someone that truly needs it can create gratefulness that will last forever.

Fund your hobby – You’ve worked hard, but how often do you play? Maybe you love frisbee golf but only have a few frisbees. Perhaps you enjoy woodworking but don’t have the tools or material to build what you’d like. Investing some of your tax refund in your hobby can give you something productive or fun to do during non-working hours. In turn, it brightens your mood and makes for a happier life.

What NOT to do with your tax refund

Quit your job and live on it for a while – While it might be tempting, in the long run this action is not going to make you happy in life. For one thing, jobs might be plentiful when you quit but not as available when you’re ready to go back to work. You lose all seniority, benefits, and the opportunity to increase your wages. And all those opportunities to spend your money above–the ones that will bring longer-term happiness–will be lost.

Put it in the bank and spend it on everyday expenses – For some people, putting the tax refund in the checking account and then spending it on everyday expenses is the easiest thing to do. Sure, there are more things you’ll do with it. Buy more pizza or fried chicken, grab more snacks at the gas station, or rent more movies. Little by little it will get spent and there will be nothing to show for it.

Go on a shopping spree and blow it all the day you get it – So, so tempting. Feels like Christmas! But it’s a one-day event and then it is all done. While you might enjoy some of what you purchased for a while, you won’t be closer to homeownership, have an emergency fund, or make your refund multiply. Long-term, you won’t be nearly as happy as if you spent it more wisely. If you feel the need for a shopping spree day, consider using only half of your refund on that day and use the rest for things that will offer more long-term gratification.

Hopefully, you now understand that how you spend your income tax refund can have an impact on your longer-term happiness in life. In the end, it’s your choice: short-term satisfaction or longer-term happiness. We hope you choose to spend your refund on the things that make you the happiest for the longest period of time!